Miami, FL, February 28, 2017 – ILG (Nasdaq: ILG) today announced results for the three months and full year ended December 31, 2016.

"We are very proud of our accomplishments in the year and enthusiastic about the future. In 2016, we completed the Vistana acquisition, positioning us at the forefront of a rapidly evolving industry by transforming our business and growth profile. In the year we delivered strong financial and operating results reflecting the contribution of Vistana and investment in the businesses. In addition, we returned a total of $153 million to shareholders through dividends and buybacks. The strength of our results and our expectations for the future enable us to announce that we are increasing our dividend by 25 percent,” said Craig M. Nash, chairman, president, and CEO of ILG. “As we begin 2017, we are well positioned to continue to deliver strong growth and shareholder value over the long term as we execute on our strategic plan."

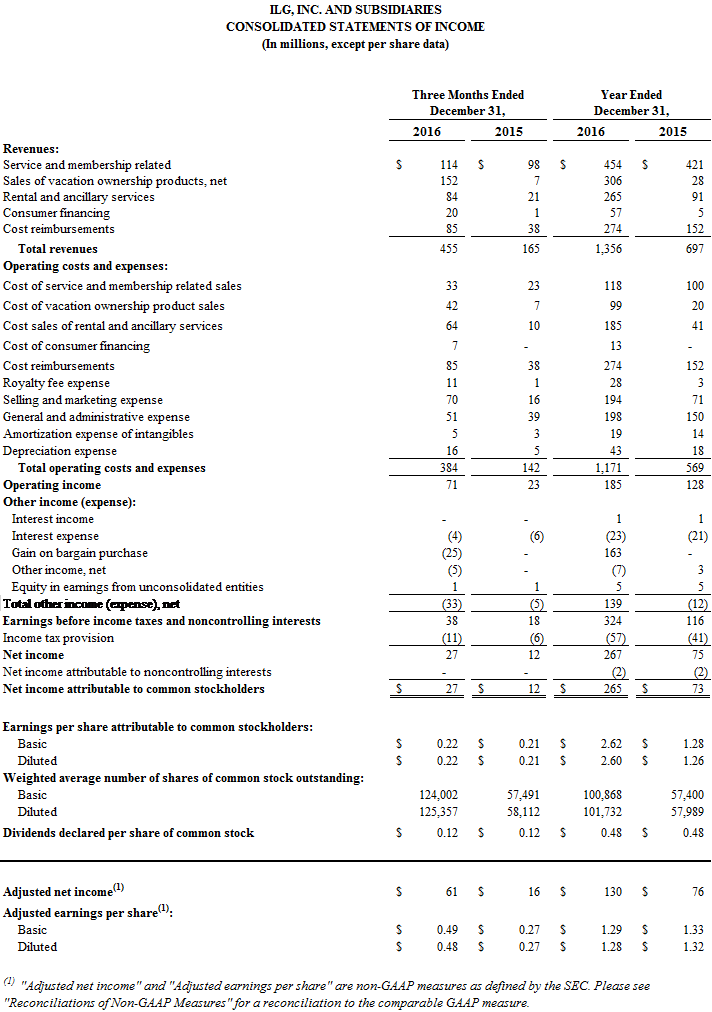

FOURTH QUARTER HIGHLIGHTS

• Consolidated revenue increased $290 million to $455 million. Excluding cost reimbursements, consolidated revenue was $370 million, $243 million more than the prior year

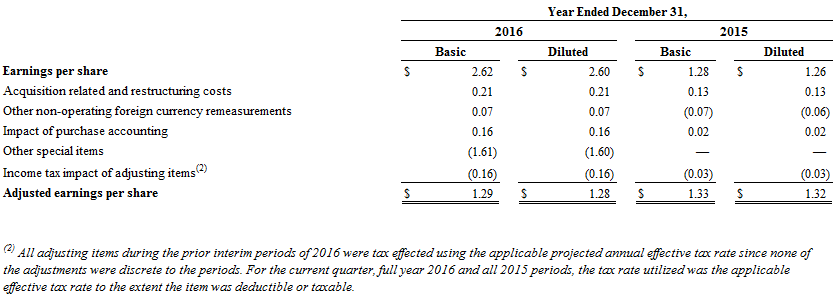

• Net income was $27 million, compared to $12 million

• Adjusted net income* was $61 million, compared to $16 million

• Diluted EPS and adjusted diluted EPS* were $0.22 and $0.48, compared to $0.21 and $0.27 in 2015

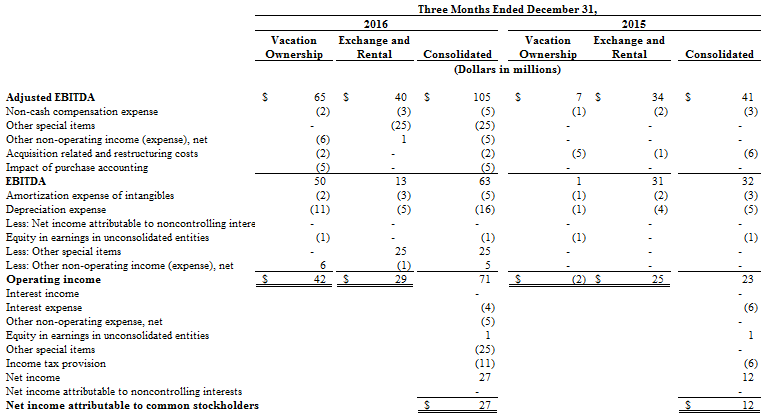

• Adjusted EBITDA* increased by $64 million to $105 million

FULL YEAR HIGHLIGHTS

• Consolidated revenue increased $659 million to $1.4 billion. Excluding cost reimbursements, consolidated revenue was $1.1 billion, $537 million more than the prior year

• Net income was $265 million and diluted EPS was $2.60, including a non-cash gain on the purchase of Vistana, compared to net income of $73 million and diluted EPS of $1.26

• Adjusted net income was $130 million and adjusted diluted EPS was $1.28, compared to adjusted net income of $76 million and adjusted diluted EPS of $1.32

• Adjusted EBITDA was $302 million, an increase of $117 million

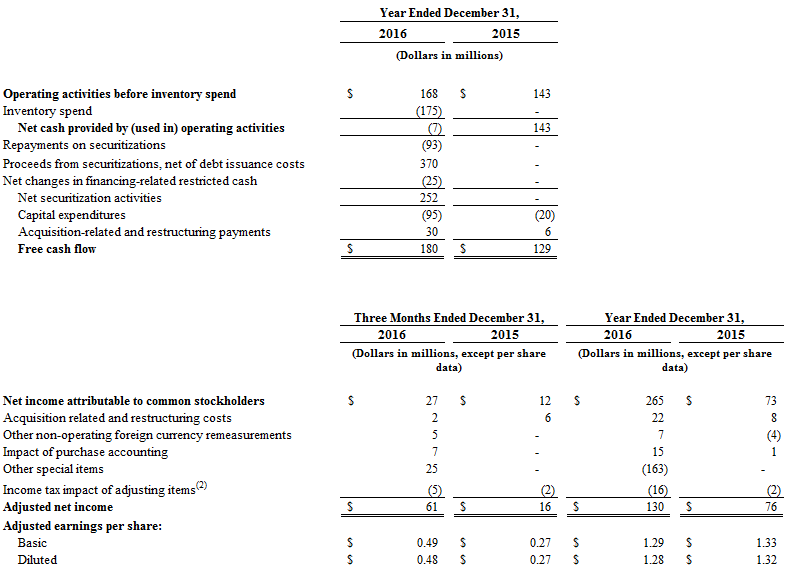

• After $175 million of inventory spend, net cash used in operating activities was $7 million

• Free cash flow* was $180 million

• We issued $375 million asset-backed notes in a securitization transaction

• ILG repurchased 6.5 million shares for approximately $101 million, and paid $52 million in dividends, returning a total of $153 million to shareholders

* “Adjusted net income”, “Adjusted diluted EPS”, “Adjusted EBITDA” and “Free cash flow” are non-GAAP measures as defined by the U.S. Securities and Exchange Commission (the “SEC”). Please see “Presentation of Financial Information,” “Glossary of Terms” and “Reconciliations of Non-GAAP Measures” below for an explanation of non-GAAP measures used throughout this release.

The acquisition of Vistana Signature Experiences, Inc. on May 11, 2016 affects the comparability of the periods presented.

Fourth quarter consolidated operating results

Consolidated revenue was $455 million, compared to $165 million primarily due to the inclusion of Vistana. Excluding cost reimbursements, consolidated revenue increased by $243 million to $370 million, also due to the transaction. The results reflect a $9 million negative impact from purchase accounting on consolidated revenue.

In connection with the Vistana acquisition, ILG recorded a non-taxable gain on purchase in the second quarter of 2016. As of December 31, 2016, the amount of the gain was provisional and subject to change only with respect to tax-related items during the measurement period. In the fourth quarter the gain was decreased by $25 million as a result of the ongoing reassessment of Vistana assets acquired and liabilities assumed.

Net income attributable to common stockholders was $27 million, more than double that of the comparable period in 2015. Impacting these results are the inclusion of Vistana, partly offset by the $25 million decrease in the gain on purchase and $9 million of tax-affected unfavorable items such as foreign currency remeasurements, the impact of purchase accounting, and acquisition-related and restructuring costs. Diluted earnings per share (EPS) was $0.22, compared to $0.21 reflecting the unfavorable items, as well as the additional shares issued in connection with the Vistana acquisition.

Adjusted net income, which excludes the decrease in the gain on purchase and the unfavorable items discussed above, was $61 million, compared to $16 million in 2015. Adjusted diluted EPS was $0.48, compared to $0.27 in the prior year.

Adjusted EBITDA increased by $64 million, to $105 million, reflecting the inclusion of Vistana.

Full year consolidated operating results

Consolidated revenue was $1.4 billion, compared to $697 million primarily due to the inclusion of Vistana. Excluding cost reimbursements, consolidated revenue increased by $537 million to $1.1 billion, also due to the transaction. The results reflect a $24 million negative impact from purchase accounting on consolidated revenue.

In connection with the Vistana acquisition, ILG recorded a non-taxable gain on purchase in the second quarter of 2016 which resulted in an effective tax rate for the year of 17.7%.

Net income attributable to common stockholders was $265 million, an increase of $192 million, compared to 2015. Impacting these results are the inclusion of Vistana and the gain on purchase, partly offset by $28 million of tax-affected unfavorable items including acquisition-related and restructuring costs, foreign currency remeasurements and the impact of purchase accounting. Diluted EPS was $2.60, compared to $1.26 in 2015, reflecting the increase in net income as well as the additional shares issued for the Vistana acquisition.

Adjusted net income, which excludes the gain on purchase and the unfavorable items described above, was $130 million, compared to $76 million in 2015. Adjusted diluted EPS was $1.28, compared to $1.32 in the prior year.

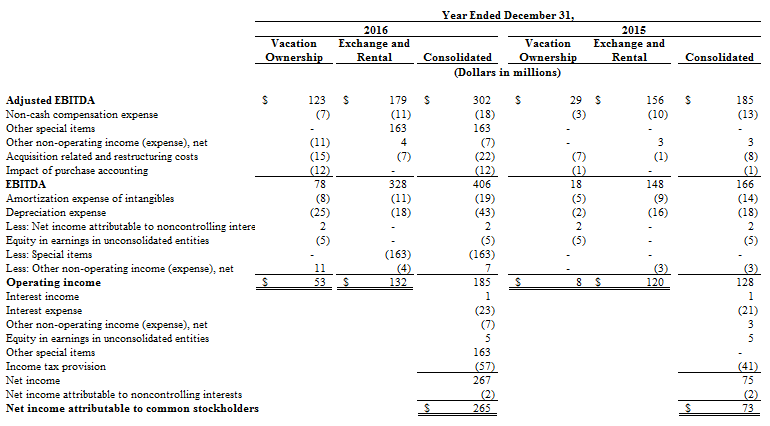

Adjusted EBITDA increased by $117 million, or 63%, to $302 million, reflecting the inclusion of Vistana.

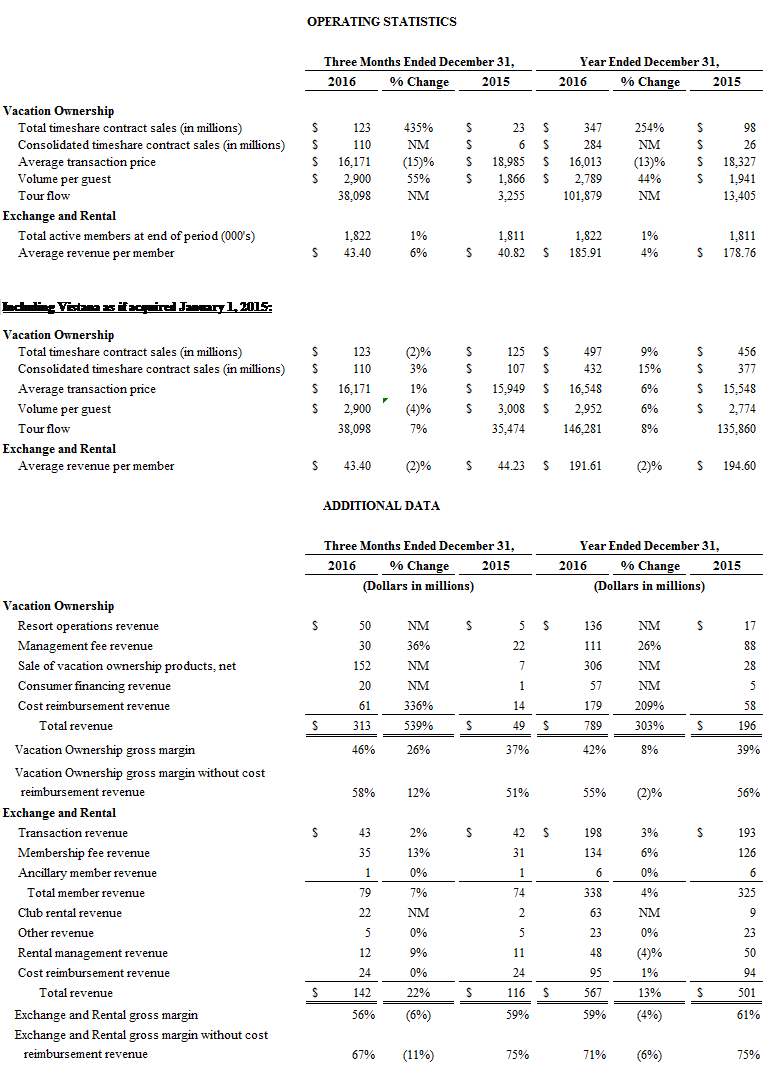

Full year business segment results

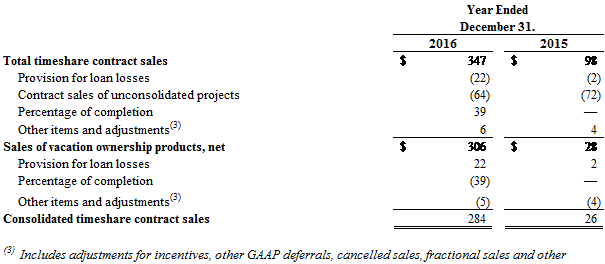

Vacation Ownership

Vacation Ownership segment revenue increased $593 million to $789 million principally resulting from the Vistana acquisition, including a $39 million benefit associated with percentage of completion accounting upon the receipt of certificates of occupancy for several projects in the fourth quarter. Excluding cost reimbursements, Vacation Ownership segment revenue increased $472 million, to $610 million, also due to the transaction. This reflects an increase of $278 million in sales of vacation ownership products and a $119 million increase in resort operations revenue, which primarily includes rentals at our vacation ownership resorts and owned hotels. Higher consumer financing and management fee revenue were also important contributors.

Excluding Vistana and cost reimbursements, revenue grew $9 million, or 7%, driven by an increase in Hyatt Vacation Ownership (“HVO”) consolidated VOI sales, higher resort operations revenue and higher management fees.

Vacation Ownership segment operating income increased from $8 million to $53 million and adjusted EBITDA increased $94 million to $123 million, due to Vistana, including $26 million associated with percentage of completion accounting. Excluding Vistana, adjusted EBITDA decreased $2 million, primarily reflecting investments in the sales and marketing infrastructure at HVO consolidated properties.

Exchange and Rental

Exchange and Rental segment revenue was $567 million, an increase of 13% compared to 2015. Excluding cost reimbursements, segment revenue was $472 million, an increase of 16% compared to 2015. The increase is related to the inclusion of Vistana Signature Network (“VSN”). The addition of this proprietary club drove the $54 million increase in club rental revenue and contributed to membership and transaction revenues.

Total Interval Network active members at year-end were 1.8 million, consistent with 2015. Average revenue per member was $185.91, an increase of 4% compared to 2015 due to the inclusion of VSN as well as membership and transaction revenue growth in the Hyatt Residence Club.

Excluding VSN and cost reimbursements, revenues decreased by 2% compared to the prior year resulting from decreased rental management revenue due to a reduction in rooms under management in Aqua-Aston, the continued shift in the percentage mix of Interval International’s membership base from traditional to corporate members, and related fee compression from corporate accounts. These declines were partly offset by higher transaction fees for Getaways and exchanges and higher club rental revenue in HVO.

Exchange and Rental segment operating income increased 10% to $132 million and adjusted EBITDA was $179 million, an increase of 15% from the prior year principally due to the inclusion of VSN. Excluding VSN, segment adjusted EBITDA increased $1 million compared to 2015 in large part due to cost savings in our Interval International exchange business.

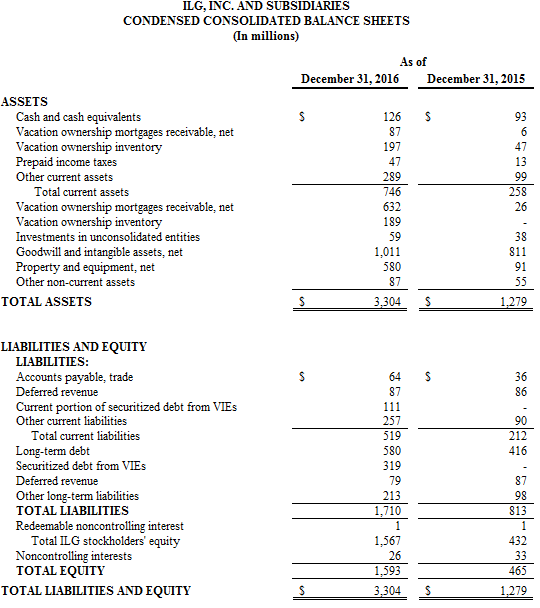

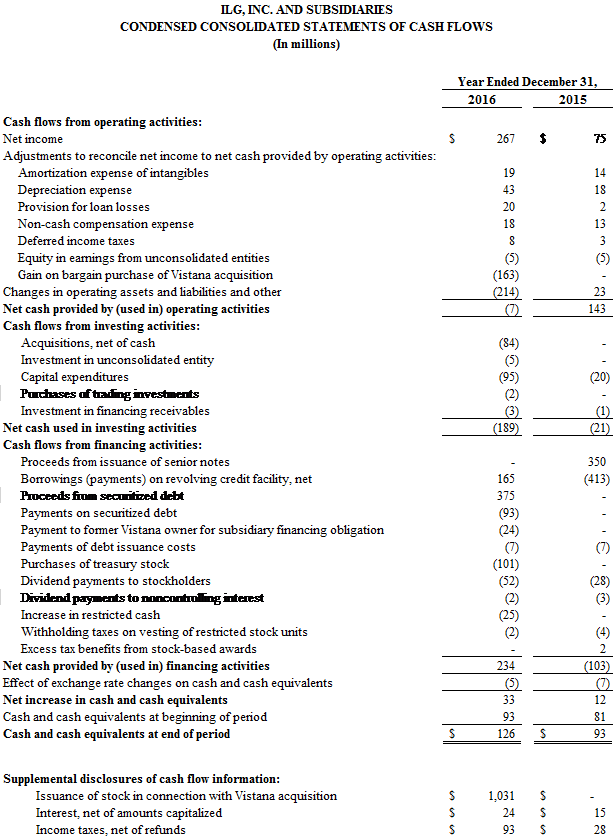

Capital Resources and Liquidity

As of December 31, 2016, ILG's cash and cash equivalents totaled $126 million, compared to $93 million at year end 2015.

The principal amount outstanding of long term corporate debt as of December 31, 2016 was $590 million consisting of $350 million 5 5/8% Senior Notes and $240 million drawn under our revolving credit facility. ILG had $349 million available on its revolving credit facility, net of outstanding letters of credit as of December 31, 2016. The revolver may be increased by $100 million under certain conditions. Net leverage at year-end was 1.5x, compared to 1.8x in 2015.

Net cash used in operating activities, which includes $175 million of inventory spend, was $7 million compared to $143 million of net cash provided by operating activities in 2015. The inventory spend was associated with investments at Vistana since the acquisition, primarily related to ongoing development activities at The Westin Nanea Ocean Villas and The Westin Los Cabos Resort Villas & Spa properties. Excluding inventory spend, net cash provided by operating activities would have been $168 million, reflecting higher net cash receipts largely attributable to the inclusion of Vistana, partly offset by higher income taxes paid of $65 million, a $10 million royalty pre-payment to Hyatt triggered by the acquisition and $9 million of higher interest paid (net of capitalized amounts).

Net cash used in investment activities was $189 million primarily related to $84 million (net of cash acquired) associated principally with the Vistana acquisition and $95 million in capital expenditures related to investments in sales galleries and other resort operation assets, as well as IT initiatives.

Net cash provided by financing activities increased $337 million to $234 million primarily related to proceeds from our $375 million securitization transaction. This increase was partly offset by $101 million in stock repurchases, $93 million repayments on securitized debt and dividend payments of $52 million.

Free cash flow (defined below) for 2016 was $180 million compared to $129 million in 2015. The increase is principally attributable to higher cash receipts and net borrowings on the $375 million securitization transaction, partly offset by inventory spend and higher capital expenditures compared to 2015 as described above, as well as a $25 million increase in financing-related restricted cash.

Dividends and Stock Repurchases

In the year ended December 31, 2016 ILG repurchased 6.5 million shares for $101 million at an average share price of $15.54 and paid $0.48 cents per share for a total of $52 million in dividends, returning $153 million to shareholders. At year-end we had $49 million available for future stock repurchases.

In February 2017, our Board of Directors increased the quarterly dividend by 25% to $0.15 per share payable March 28, 2017 to shareholders of record on March 14, 2017.

BUSINESS OUTLOOK AND GUIDANCE

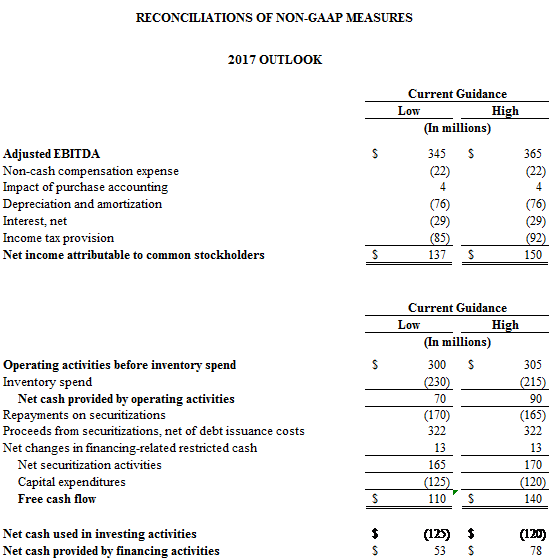

The 2017 Outlook schedule reconciles the non-GAAP financial measures in our full year 2017 guidance to the following expected GAAP results:

|

(in millions) |

|

|

||

|

|

Low |

High |

||

|

Net income attributable to common stockholders |

137 |

150 |

||

|

Net cash provided by operating activities |

70 |

90 |

||

2017 Full year guidance

|

(in millions) |

Current |

|

|

|

|

|

Low |

High |

|

|

|

Consolidated revenue* |

1,730 |

1,855 |

|

|

|

Adjusted EBITDA |

345 |

365 |

|

|

|

Free cash flow |

110 |

140 |

|

|

|

* Includes an estimated $340 to $365 million of cost reimbursements |

||||

In 2017 we expect our effective tax rate to be approximately 38%, absent the impact of discrete items or other items that may cause volatility in the rate.

PRESENTATION OF FINANCIAL INFORMATION

ILG management believes that the presentation of non-generally accepted accounting principles (non-GAAP) financial measures, including, among others, EBITDA, adjusted EBITDA, adjusted net income, adjusted basic and diluted EPS, free cash flow and constant currency, serves to enhance the understanding of ILG's performance. These non-GAAP financial measures should be considered in addition to and not as substitutes for, or superior to, measures of financial performance prepared in accordance with generally accepted accounting principles (GAAP). In addition, adjusted EBITDA (with certain different adjustments) is used to calculate compliance with certain financial covenants in ILG's credit agreement and indenture. Management believes that these non-GAAP measures improve the transparency of our disclosures, provide meaningful presentations of our results from our business operations excluding the impact of certain items not related to our core business operations and improve the period to period comparability of results from business operations. These measures may also be useful in comparing our results to those of other companies; however, our calculations may differ from the calculations of these measures used by other companies. More information about the non-GAAP financial measures, including reconciliations of historical GAAP results to the non-GAAP measures, is available in the financial tables that accompany this press release.

CONFERENCE CALL

Investors and analysts may participate in the live conference call by dialing (844) 832-7221 (toll-free domestic) or (973) 638-3062 (international); Conference ID: 68382122. Please register at least 10 minutes before the conference call begins. A replay of the call will be available for 7 days via telephone starting approximately two hours after the call ends. The replay can be accessed at (855) 859-2056 (toll-free domestic) or (404) 537-3406 (international); Conference ID: 68382122. The webcast will be archived on ILG’s website for 90 days after the call. A transcript of the call will also be available on the website.

ABOUT ILG

ILG (Nasdaq: ILG) is a leading provider of professionally delivered vacation experiences and the exclusive global licensee for the Hyatt®, Sheraton®, and Westin® brands in vacation ownership. The company offers its owners, members, and guests access to an array of benefits and services, as well as world-class destinations through its international portfolio of resorts and clubs. ILG’s operating businesses include Aqua-Aston Hospitality, Hyatt Vacation Ownership, Interval International, Trading Places International, Vacation Resorts International, VRI Europe, and Vistana Signature Experiences. Through its subsidiaries, ILG independently owns and manages the Hyatt Residence Club program and uses the Hyatt Vacation Ownership name and other Hyatt® marks under license from affiliates of Hyatt Hotels Corporation. In addition, ILG’s Vistana Signature Experiences, Inc. is the exclusive provider of vacation ownership for the Sheraton and Westin brands and uses related trademarks under license from Starwood Hotels & Resorts Worldwide, LLC. Headquartered in Miami, Florida, ILG has offices in 15 countries and approximately 10,000 employees. For more information, visit www.ilg.com.

.

CAUTIONARY LANGUAGE CONCERNING FORWARD-LOOKING STATEMENTS

Information set forth in this release, including statements regarding our future financial performance, our business prospects and strategy, anticipated financial position, liquidity, capital needs and other similar matters constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of the management of ILG and are subject to significant risks and uncertainties outside of ILG’s control.

Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: (1) adverse trends in economic conditions generally or in the vacation ownership, vacation rental and travel industries, or adverse events or trends in key vacation destinations, (2) lack of available financing for, or insolvency or consolidation of developers, including availability of receivables financing for our business, (3) adverse changes to, or interruptions in, relationships with third parties, (4) our ability to compete effectively and successfully and to add new products and services, (5) our ability to market VOIs successfully and efficiently, (6) our ability to source sufficient inventory to support VOI sales and risks related to development of inventory in accordance with applicable brand standards, (7) the occurrence of a termination event under the master license agreement with Starwood or Hyatt, (8) actions of Starwood, Hyatt or any successor that affect the reputation of the licensed marks, the offerings of or access to these brands and programs, (8) decreased demand from prospective purchasers of vacation interests, (9) travel related health concerns, (10) significant increase in defaults on our vacation ownership mortgage receivables; (11) the restrictive covenants in our revolving credit facility and indenture and our ability to refinance our debt on acceptable terms; (12) our ability to successfully manage and integrate acquisitions, including Vistana, (13) impairment of ILG’s assets or other adverse changes to estimates and assumptions underlying our financial results, (14) our ability to expand successfully in international markets and manage risks specific to international operations (15) fluctuations in currency exchange rates, (16) the ability of managed homeowners associations to collect sufficient maintenance fees, (17) business interruptions in connection with technology systems, and (18) regulatory changes.

|

|

|

|

|

|

|

|

|

|

GLOSSARY OF TERMS

Acquisition related and restructuring costs - Represents transaction fees, costs incurred in connection with performing due diligence, subsequent adjustments to our initial estimate of contingent consideration obligations associated with business acquisitions, and other direct costs related to acquisition activities. Additionally, this item includes certain restructuring charges primarily related to workforce reductions, costs associated with integrating acquired businesses and estimated costs of exiting contractual commitments.

Adjusted earnings per share (EPS) is defined as adjusted net income divided by the weighted average number of shares of common stock outstanding during the period for basic EPS and, additionally, inclusive of dilutive securities for diluted EPS.

Adjusted EBITDA - EBITDA, excluding, if applicable: (1) non-cash compensation expense, (2) goodwill and asset impairments, (3) acquisition related and restructuring costs, (4) other non-operating income and expense, (5) the impact of the application of purchase accounting, and (6) other special items. The Company's presentation of adjusted EBITDA may not be comparable to similarly-titled measures used by other companies.

Adjusted net income is defined as net income attributable to common stockholders, excluding the impact of (1) acquisition related and restructuring costs, (2) other non-operating foreign currency remeasurements, (3) the impact of the application of purchase accounting, and (4) other special items.

Ancillary member revenue - Other Interval Network member related revenue including insurance and travel related services.

Average revenue per member - Membership fee revenue, transaction revenue and ancillary member revenue for the Interval Network, Vistana Signature Network and Hyatt Residence Club for the applicable period, divided by the monthly weighted average number of Interval Network active members during the applicable period. Vistana Signature Network revenue is included herein only since its date of acquisition.

Average transaction price – Consolidated timeshare contract sales divided by the net number of transactions during the period.

Club rental revenue – Represents rentals generated by the Vistana Signature Network and Hyatt Residence Club mainly to monetize inventory to provide exchanges through hotel loyalty programs.

Constant currency – Represents current period results of operations determined by translating the functional currency results into dollars (the reporting currency) using the actual blended rate of translation from the comparable prior period. Management believes that the presentation of results of operations excluding the effect of foreign currency translations serves to enhance the understanding of ILG’s performance and improves period to period comparability of results from business operations.

Consolidated timeshare contract sales – Total timeshare interests sold at consolidated projects pursuant to purchase agreements, net of actual cancellations and rescissions, where we have met a minimum threshold amounting to a 10% down payment of the contract purchase price during the period.

Consumer financing revenue – Includes interest income on vacation ownership mortgages receivable, as well as fees from servicing the existing securitized portion of Vistana’s receivables portfolio.

Cost reimbursements - Represents the compensation and other employee-related costs directly associated with managing properties that are included in both revenue and cost of sales and that are passed on to the property owners or homeowner associations without mark-up. Cost reimbursement revenue of the Vacation Ownership segment also includes reimbursement of sales and marketing expenses, without mark-up, pursuant to contractual arrangements. Management believes presenting gross margin without these expenses provides management and investors a relevant period-over-period comparison.

EBITDA - Net income attributable to common stockholders excluding, if applicable: (1) non-operating interest income and interest expense, (2) income taxes, (3) depreciation expense, and (4) amortization expense of intangibles.

Free cash flow – is defined as cash provided by operating activities less capital expenditures and repayment activity related to securitizations, plus net changes in financing-related restricted cash and proceeds from securitizations (net of fees). This metric also excludes certain payments unrelated to our ongoing core business, such as acquisition-related and restructuring expenses.

Management fee revenue – Represents vacation ownership property management revenue earned by our Vacation Ownership segment exclusive of cost reimbursements.

Membership fee revenue – Represents fees paid for membership in the Interval Network, Vistana Signature Network and Hyatt Residence Club.

Net leverage – Long term debt (excluding issuance costs) minus cash and cash equivalents divided by Adjusted EBITDA.

Other special items – consist of other items that we believe are not related to our core business operations. For the three and twelve month periods ended December 31, 2016, includes the gain on purchase (or change therein) associated with the Vistana acquisition.

Other revenue – includes revenue related primarily to exchange and rental transaction activity and membership programs outside of the Interval Network, Vistana Signature Network and Hyatt Residence Club, sales of marketing materials primarily for point-of-sale developer use, and certain financial services-related fee income.

Rental and ancillary services revenue – Includes our rental activities such as Getaways, club rentals and owned hotel revenues, as well as associated resort ancillary revenues.

Rental management revenue – Represents rental management revenue earned by our vacation rental businesses within our Exchange and Rental segment, exclusive of cost reimbursement revenue.

Resort operations revenue – Pertains to our revenue generating activities from rentals of owned vacation ownership inventory (exclusive of lead-generation) along with ancillary resort services, in addition to rental and ancillary revenue generated by owned hotels.

Sales of vacation ownership products, net – Includes sales of vacation ownership products, net, for HVO and Vistana.

Service and membership revenue – Revenue associated with providing services including membership-related activities and exchange transactions, as well vacation ownership and vacation rental management businesses.

Total active members - Active members of the Interval Network as of the end of the period. Active members are members in good standing that have paid membership fees and any other applicable charges in full as of the end of the period or are within the allowed grace period. All Vistana Signature Network and Hyatt Residence Club members are also members of the Interval Network.

Total timeshare contract sales – Total timeshare interests sold at consolidated and unconsolidated projects pursuant to purchase agreements, net of actual cancellations and rescissions, where we have met a minimum threshold amounting to a 10% down payment of the contract purchase price during the period.

Tour flow – Represents the number of sales presentations given at sales centers (other than at unconsolidated properties) during the period.

Transaction revenue – Interval Network, Vistana Signature Network and Hyatt Residence Club transactional and service fees paid primarily for exchanges, Getaways, reservation servicing and related transactions.

Volume per guest – Consolidated timeshare contract sales divided by tour flow during the period.

ILG, Inc.

Investor Contact:

Lily Arteaga, 305-925-7302

Investor Relations

Lily.Arteaga@ilg.com

Or

Media Contact:

Christine Boesch, 305-925-7267

Corporate Communications

Chris.Boesch@ilg.com