Miami, FL, May 3, 2018 – ILG (Nasdaq: ILG) today announced results for the first quarter ended March 31, 2018.

FIRST QUARTER HIGHLIGHTS

• Consolidated revenue increased 9% to $482 million

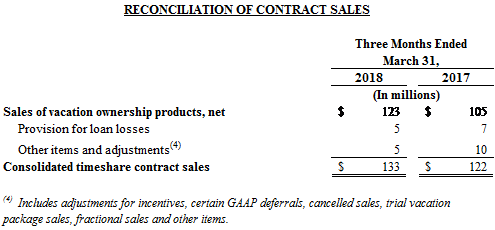

• Consolidated timeshare contract sales were higher by 9%

• Net income attributable to common stockholders was $43 million

• Adjusted net income* was $46 million, up 10%

• Diluted EPS and adjusted diluted EPS* were $0.34 and $0.36, respectively

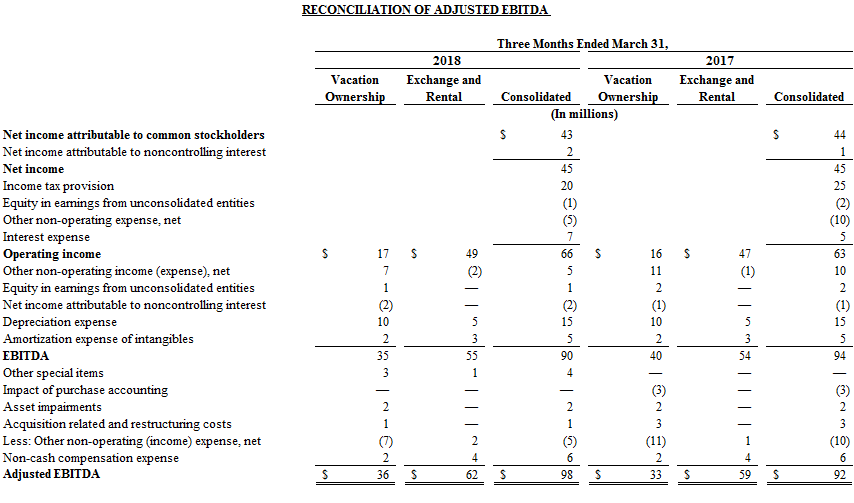

• Adjusted EBITDA* was $98 million, higher by 7%

• Excluding the estimated impact of the hurricanes, our results would have been the following:

• Consolidated revenue of $501 million, up 13%

• Consolidated timeshare contract sales of $143 million, higher by 17%

• Net income attributable to common stockholders of $48 million, up 9%

• Adjusted net income of $50 million, higher by 19%

• Adjusted EBITDA of $104 million, up 13%

• Diluted EPS and adjusted diluted EPS of $0.38 and $0.39, respectively

• Net cash from operating activities was $152 million

• Free cash flow* was $66 million, higher by 22%

• ILG paid $22 million in dividends

• On April 30, 2018 we announced a definitive agreement relating to a combination of ILG with Marriott Vacations Worldwide

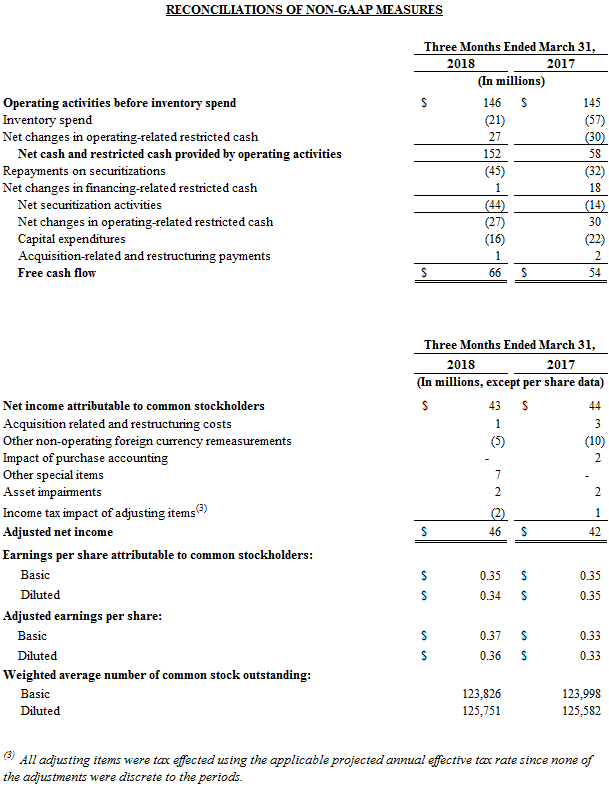

* “Adjusted net income”, “Adjusted diluted EPS”, “Adjusted EBITDA” and “Free Cash Flow” are non-GAAP measures as defined by the U.S. Securities and Exchange Commission (the “SEC”). Please see “Presentation of Financial Information,” “Glossary of Terms” and “Reconciliations of Non-GAAP Measures” below for an explanation of non-GAAP measures used throughout this release.

Hurricane Impact

In September 2017, Hurricanes Irma and Maria affected several Vistana and HVO resorts and sales centers, as well as nearly 300 properties within the Interval Network or managed by VRI or Aqua-Aston Hospitality. At March 31, 2018 our Westin St. John Resort Villas in the U.S. Virgin Islands and Hyatt Residence Club Dorado, Hacienda del Mar, in Puerto Rico were closed and expected to reopen early in 2019. Approximately 50 Interval Network properties on the hardest-hit islands were also closed at quarter end. However, a number of them are expected to reopen in the second quarter.

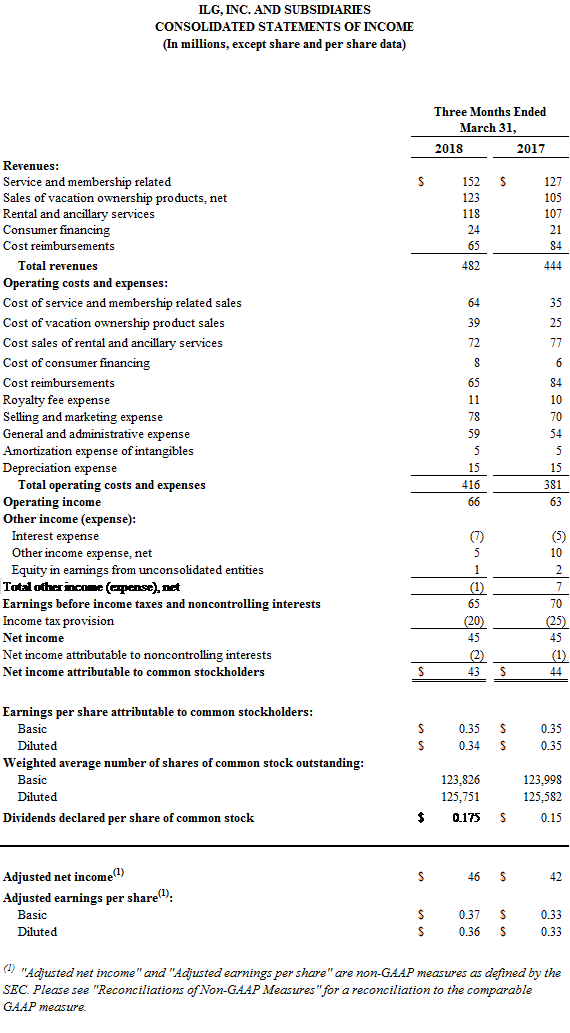

First quarter consolidated operating results

Consolidated revenue was $482 million, and excluding the estimated hurricane impact, it would have been $501 million, up 13% over the prior year driven by strong performance in our vacation ownership segment.

Net income attributable to common stockholders was $43 million. Excluding the estimated impact of the hurricanes it would have been $48 million, up 9% compared to the prior year. Diluted earnings per share (EPS) was $0.34, compared to $0.35.

Adjusted net income was $46 million, compared to $42 million in 2017. Excluding the estimated impact from the hurricane, it would have been $50 million, up 19% compared to the prior year. Adjusted diluted EPS was $0.36. Excluding the impact from the hurricane it would have been $0.39, higher by 18%.

Adjusted EBITDA increased 7% to $98 million. Excluding the impact from the hurricane, it would have been $104 million, an increase of 13% compared to 2017.

Business segment results

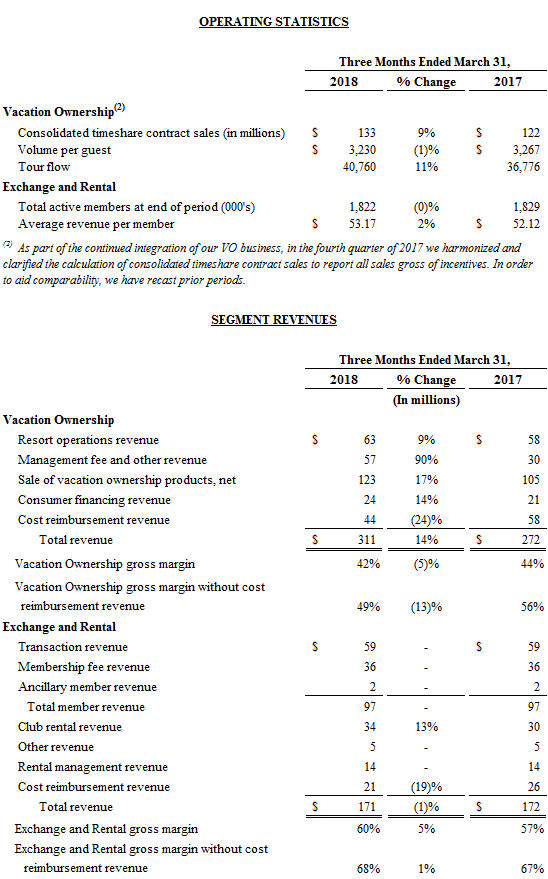

Vacation Ownership

Excluding cost reimbursements, Vacation Ownership segment revenue increased $53 million, to $267 million principally as a result of the following:

• $27 million increase in management fee and other revenue predominantly attributable to revenue from the consolidation of our HOAs starting in the fourth quarter of 2017. This increase is largely offset by a corresponding decrease in cost reimbursement revenue.

• $18 million increase in sales of vacation ownership products principally attributable to higher consolidated contract sales largely due to an 11% increase in tour flow.

• $5 million increase in resort operations revenue primarily driven by higher available and occupied room nights and average daily rate resulting from the increase in the number of units which came on-line beginning in the second quarter of 2017.

Vacation Ownership segment operating income increased 6% to $17 million and adjusted EBITDA was higher by $3 million to $36 million driven primarily from higher VO sales and stronger performance in our resort operations. Excluding the impact of the hurricanes, the increase in Adjusted EBITDA would have been $8 million to $41 million, 24% higher than 2017.

Exchange and Rental

Exchange and Rental segment revenue was $171 million dollars, relatively consistent with 2017. Excluding cost reimbursements, segment revenue was up 3% to $150 million dollars related to stronger club rental revenue resulting from the above- mentioned increase in available and occupied room nights and average daily rate.

Total Interval Network active members at quarter-end were 1.8 million, consistent with 2017, and average revenue per member was $53.17, up 2%.

Operating income for the segment was $49 million, up 4%. Adjusted EBITDA for the segment increased 5% to $62 million dollars primarily driven by the stronger club rental activity. Excluding the estimated hurricane impact, the increase in Adjusted EBITDA would have been 7%.

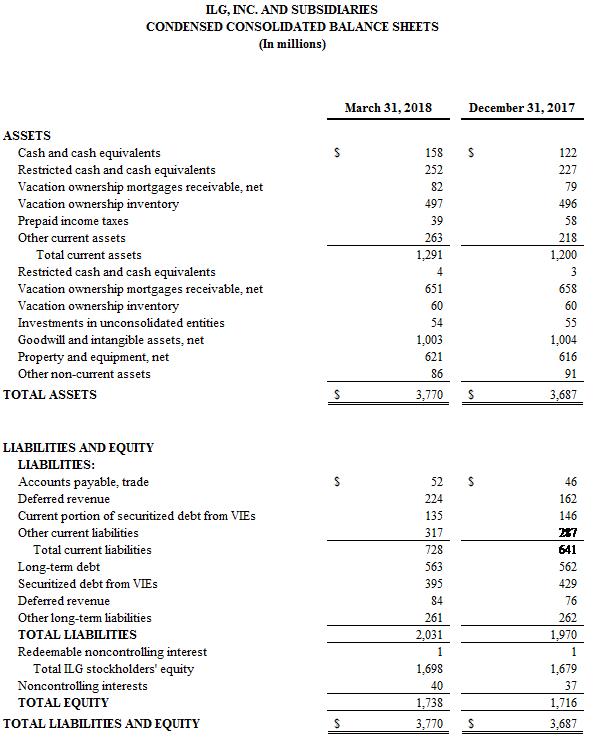

Capital Resources and Liquidity

As of March 31, 2018, ILG's cash and cash equivalents totaled $158 million, compared to $122 million on December 31, 2017, and we had $204 million of eligible unsecuritized receivables.

The principal amount outstanding of long term corporate debt as of March 31, 2018 was $570 million consisting of $350 million 5 5/8% Senior Notes and $220 million drawn under our revolving credit facility.

ILG had $366 million available on its revolving credit facility, net of outstanding letters of credit as of March 31, 2018.

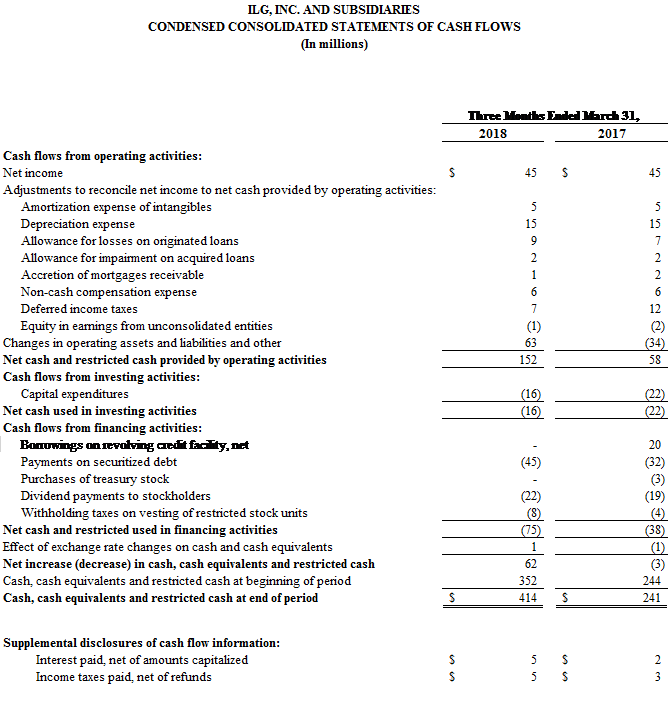

Net cash and restricted cash provided by operating activities in the first three months of 2018 was $152 million compared to $58 million. The $94 million increase was principally due higher net cash receipts partly attributable to property insurance proceeds of $42 million related primarily to the damage caused by the 2017 hurricanes on our Westin St. John resort. In addition, inventory spend was lower by $36 million and restricted cash increased $27 million primarily reflecting the collection of maintenance fees following the consolidation of our HOAs beginning in the fourth quarter of last year.

Net cash used in investing activities was $16 million primarily related to capex associated with resort operations and sales and marketing locations, as well as IT initiatives. Capex in the quarter includes an offsetting $3 million of insurance proceeds for hurricane property damage.

Net cash and restricted cash used in financing activities was $75 million, reflecting $45 million repayments on securitized debt, a dividend payment of $22 million, and $8 million withholding tax on the vesting of restricted stock units and shares.

Free cash flow for the quarter was $66 million, compared to $54 million in 2017. The change is primarily a result of the increase in net cash and restricted cash provided by operating activities, and lower capital expenditures, partially offset by higher net securitization activities, including higher repayments on securitizations.

Dividends

During the first quarter of 2018, ILG paid $22 million, or $0.175 cents per share in dividends. In May 2018, our Board of Directors declared a $0.175 per share dividend payable June 12, 2018 to shareholders of record on June 1, 2018.

Combination with Marriott Vacations

On April 30, 2018, ILG announced it had entered into an agreement whereby Marriott Vacations Worldwide, Inc. (Marriott Vacations) will acquire ILG for a combination of cash and stock consideration which values the company at approximately $5.1 billion, based on Marriott Vacation’s closing price on April 27, 2018.

ILG shareholders will receive $14.75 per share in cash and the rest in newly issued shares of Marriott Vacations. The combination will result in ILG shareholders owning at closing 43.1% of the company on a fully-diluted basis, based on a fixed exchange ratio. Two ILG directors will be appointed to the board of the combined company.

The transaction, which is subject to shareholder and regulatory approvals, is expected to close in the second half of 2018. More information on the transaction can be found on the ILG website, ww.ilg.com.

PRESENTATION OF FINANCIAL INFORMATION

ILG management believes that the presentation of non-generally accepted accounting principles (non-GAAP) financial measures, including, among others, EBITDA, adjusted EBITDA, adjusted net income, adjusted basic and diluted EPS, and free cash flow, serves to enhance the understanding of ILG's performance. These non-GAAP financial measures should be considered in addition to and not as substitutes for, or superior to, measures of financial performance and liquidity prepared in accordance with generally accepted accounting principles (GAAP). In addition, adjusted EBITDA (with certain different adjustments) is used to calculate compliance with certain financial covenants in ILG's credit agreement and indenture. Management believes that these non-GAAP measures improve the transparency of our disclosures, provide meaningful presentations of our results from our business operations and liquidity excluding the impact of certain items not related to our core business operations and improve the period to period comparability of results from business operations. These measures may also be useful in comparing our results to those of other companies; however, our calculations may differ from the calculations of these measures used by other companies. More information about the non-GAAP financial measures, including reconciliations of historical GAAP results to the non-GAAP measures, is available in the financial tables that accompany this press release.

CONFERENCE CALL

Investors and analysts may listen to the live conference call by dialing (844) 832-7221 (toll-free domestic) or (973) 638-3062 (international); Conference ID: 2599704. Please register at least 10 minutes before the conference call begins. A replay of the call will be available for 7 days via telephone starting approximately two hours after the call ends. The replay can be accessed at (855) 859-2056 (toll-free domestic) or (404) 537-3406 (international); Conference ID: 2599704. The webcast will be archived on ILG’s website for 90 days after the call. A transcript of the call will also be available on the website.

ABOUT ILG

ILG (Nasdaq: ILG) is a leading provider of professionally delivered vacation experiences and the exclusive global licensee for the Hyatt®, Sheraton®, and Westin® brands in vacation ownership. The company offers its owners, members, and guests access to an array of benefits and services, as well as world-class destinations through its international portfolio of resorts and clubs. ILG’s operating businesses include Aqua-Aston Hospitality, Hyatt Vacation Ownership, Interval International, Trading Places International, Vacation Resorts International, VRI Europe, and Vistana Signature Experiences. Through its subsidiaries, ILG independently owns and manages the Hyatt Residence Club program and uses the Hyatt Vacation Ownership name and other Hyatt marks under license from affiliates of Hyatt Hotels Corporation. In addition, ILG’s Vistana Signature Experiences, Inc. is the exclusive provider of vacation ownership for the Sheraton and Westin brands and uses related trademarks under license from Starwood Hotels & Resorts Worldwide, LLC. Headquartered in Miami, Florida, ILG has offices in 15 countries and more than 10,000 associates. For more information, visit www.ilg.com.

Cautionary Statement Regarding Forward Looking Statements

Information included or incorporated by reference in this communication, and information which may be contained in other filings with the Securities and Exchange Commission (the “SEC”) and press releases or other public statements, contains or may contain “forward-looking” statements, as that term is defined in the Private Securities Litigation Reform Act of 1995 or by the SEC in its rules, regulations and releases. These forward-looking statements include, among other things, statements of plans, objectives, expectations (financial or otherwise) or intentions.

Forward-looking statements are any statements other than statements of historical fact, including statements regarding ILG’s and Marriott Vacations’ expectations, beliefs, hopes, intentions or strategies regarding the future. Among other things, these forward-looking statements may include statements regarding the proposed combination of ILG and Marriott Vacations; our beliefs relating to value creation as a result of a potential combination with Marriott Vacations; the expected timetable for completing the transactions; benefits and synergies of the transactions; future opportunities for the combined company; and any other statements regarding ILG’s and Marriott Vacations’ future beliefs, expectations, plans, intentions, financial condition or performance. In some cases, forward-looking statements can be identified by the use of words such `as “may,” “will,” “expects,” “should,” “believes,” “plans,” “anticipates,” “estimates,” “predicts,” “potential,” “continue,” or other words of similar meaning.

Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those discussed in, or implied by, the forward-looking statements. Factors that might cause such a difference include, but are not limited to, general economic conditions, our financial and business prospects, our capital requirements, our financing prospects, our relationships with associates and labor unions, our ability to consummate potential acquisitions or dispositions, our relationships with the holders of licensed marks, and those additional factors disclosed as risks in other reports filed by us with the Securities and Exchange Commission, including those described in Part I of our most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K as well as on Marriott Vacations’ most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K.

Other risks and uncertainties include the timing and likelihood of completion of the proposed transactions between ILG and Marriott Vacations, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals for the proposed transactions that could reduce anticipated benefits or cause the parties to abandon the transactions; the possibility that ILG’s stockholders may not approve the proposed transactions; the possibility that Marriott Vacations’ stockholders may not approve the proposed transactions; the possibility that the expected synergies and value creation from the proposed transactions will not be realized or will not be realized within the expected time period; the risk that the businesses of ILG and Marriott Vacations will not be integrated successfully; disruption from the proposed transactions making it more difficult to maintain business and operational relationships; the risk that unexpected costs will be incurred; the ability to retain key personnel; the availability of financing; the possibility that the proposed transactions do not close, including due to the failure to satisfy the closing conditions; as well as more specific risks and uncertainties. You should carefully consider these and other relevant factors, including those risk factors in this communication and other risks and uncertainties that affect the businesses of ILG and Marriott Vacations described in their respective filings with the SEC, when reviewing any forward-looking statement. These factors are noted for investors as permitted under the Private Securities Litigation Reform Act of 1995. We caution readers that any such statements are based on currently available operational, financial and competitive information, and they should not place undue reliance on these forward-looking statements, which reflect management’s opinion only as of the date on which they were made. Except as required by law, we disclaim any obligation to review or update these forward-looking statements to reflect events or circumstances as they occur.

NO OFFER OR SOLICITATION

This communication is for informational purposes only and is not intended to and does not constitute an offer to buy, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

IMPORTANT INFORMATION AND WHERE TO FIND IT

The proposed transaction involving Marriott Vacations and ILG will be submitted to ILG’s stockholders and Marriott Vacations’ stockholders for their consideration. In connection with the proposed transaction, Marriott Vacations will prepare a registration statement on Form S-4 that will include a joint proxy statement/prospectus for ILG’s stockholders and Marriott Vacations’ stockholders to be filed with the Securities and Exchange Commission (“SEC”). ILG will mail the joint proxy statement/prospectus to its stockholders, Marriott Vacations will mail the joint proxy statement/prospectus to its stockholders and ILG and Marriott Vacations will file other documents regarding the proposed transaction with the SEC. This communication is not intended to be, and is not, a substitute for such filings or for any other document that Marriott Vacations or ILG may file with the SEC in connection with the proposed transaction. SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The registration statement, the joint proxy statement/prospectus and other relevant materials (if and when they become available) and any other documents filed or furnished by Marriott Vacations or ILG with the SEC may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus from Marriott Vacations by going to its investor relations page on its corporate web site at www.marriottvacationsworldwide.com and from ILG by going to its investor relations page on its corporate web site at www.ilg.com.

PARTICIPANTS IN THE SOLICITATION

Marriott Vacations, ILG, their respective directors and certain of their respective executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Marriott Vacations’ directors and executive officers is set forth in its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 27, 2018, and in its definitive proxy statement filed with the SEC on April 3, 2018, and information about ILG’s directors and executive officers is set forth in its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on March 1, 2018 and on Form 10-K/A filed with the SEC on April 30, 2018. These documents are available free of charge from the sources indicated above, and from Marriott Vacations by going to its investor relations page on its corporate web site at www.marriottvacationsworldwide.com and from ILG by going to its investor relations page on its corporate web site at www.ilg.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the registration statement, the joint proxy statement/prospectus and other relevant materials Marriott Vacations and ILG file with the SEC.

GLOSSARY OF TERMS

Acquisition related and restructuring costs - Represents transaction fees, costs incurred in connection with performing due diligence, subsequent adjustments to our initial estimate of contingent consideration obligations associated with business acquisitions, and other direct costs related to acquisition activities. Additionally, this item includes certain restructuring charges primarily related to workforce reductions, costs associated with integrating acquired businesses and estimated costs of exiting contractual commitments.

Adjusted earnings per share (EPS) is defined as adjusted net income divided by the weighted average number of shares of common stock outstanding during the period for basic EPS and, additionally, inclusive of dilutive securities for diluted EPS.

Adjusted EBITDA - EBITDA, excluding, if applicable: (1) non-cash compensation expense, (2) goodwill and asset impairments, (3) acquisition related and restructuring costs, (4) other non-operating income and expense, (5) the impact of the application of purchase accounting, and (6) other special items. The Company's presentation of adjusted EBITDA may not be comparable to similarly-titled measures used by other companies.

Adjusted net income is defined as net income attributable to common stockholders, excluding the impact of (1) acquisition related and restructuring costs, (2) other non-operating foreign currency remeasurements, (3) the impact of the application of purchase accounting, (4) goodwill and asset impairments, and (5) other special items.

Ancillary member revenue - Other Interval Network member related revenue including insurance and travel related services.

Average revenue per member - Membership fee revenue, transaction revenue and ancillary member revenue for the Interval Network, Vistana Signature Network and Hyatt Residence Club for the applicable period, divided by the monthly weighted average number of Interval Network active members during the applicable period.

Club rental revenue – Represents rentals generated by the Vistana Signature Network and Hyatt Residence Club mainly to monetize inventory to provide exchanges through hotel loyalty programs.

Consolidated timeshare contract sales – Total timeshare interests sold at consolidated projects pursuant to purchase agreements, gross of incentives and net of actual cancellations and rescissions, where we have met a minimum threshold amounting to a 10% down payment of the contract purchase price during the period. For upgrade sales, we include only the incremental value purchased.

Consumer financing revenue – Includes interest income on vacation ownership mortgages receivable, as well as loan servicing fees from unconsolidated entities.

Cost reimbursements - Represents the compensation and other employee-related costs directly associated with managing properties that are included in both revenue and cost of sales and that are passed on to the property owners or homeowner associations without mark-up. Cost reimbursement revenue of the Vacation Ownership segment also includes reimbursement, without mark-up, of sales and marketing expenses, and in some cases certain other expenses pursuant to contractual arrangements. Management believes presenting gross margin without these expenses provides management and investors a relevant period-over-period comparison.

EBITDA - Net income attributable to common stockholders excluding, if applicable: (1) non-operating interest income and interest expense, (2) income taxes, (3) depreciation expense, and (4) amortization expense of intangibles.

Free cash flow – is defined as cash and restricted cash provided by operating activities less capital expenditures, plus net changes in financing-related restricted cash and net borrowing and repayment activity pertaining to securitizations, and excluding changes in operating-related restricted cash and certain payments unrelated to our ongoing core business, such as acquisition-related and restructuring costs.

Impact of the application of purchase accounting – represents the difference between amounts derived from the fair value remeasurement of assets and liabilities acquired in a business combination versus the historical basis. We believe generally this is most meaningful in the first year subsequent to an acquisition.

Management fee revenue – Represents vacation ownership property management revenue earned by our Vacation Ownership segment exclusive of cost reimbursements.

Membership fee revenue – Represents fees paid for membership in the Interval Network, Vistana Signature Network and Hyatt Residence Club.

Net leverage – Long term debt (excluding issuance costs) minus cash and cash equivalents divided by Adjusted EBITDA.

Other special items – consist of other items that we believe are not related to our core business operations. For the three months ended March 31, 2018 and 2017, such items include (as applicable to the respective period): (i) costs related to non-ordinary course litigation matters described in the notes to our financial statements, (ii) impact to our financial statements related to natural disasters, including Hurricane Irma and other named storms, and (iii) costs related to our Board’s strategic review.

Other revenue – includes revenue related primarily to exchange and rental transaction activity and membership programs outside of the Interval Network, Vistana Signature Network and Hyatt Residence Club, sales of marketing materials primarily for point-of-sale developer use, and certain financial services-related fee income.

Rental and ancillary services revenue – Includes our rental activities such as Getaways, club rentals and owned hotel revenues, as well as associated resort ancillary revenues.

Rental management revenue – Represents rental management revenue earned by our vacation rental businesses within our Exchange and Rental segment, exclusive of cost reimbursement revenue.

Resort operations revenue – Pertains to our revenue generating activities from rentals of owned vacation ownership inventory (exclusive of lead-generation) along with ancillary resort services, in addition to rental and ancillary revenue generated by owned hotels.

Sales of vacation ownership products, net – Includes sales of vacation ownership products, net, for HVO and Vistana.

Service and membership revenue – Revenue associated with providing services including membership-related activities and exchange transactions, as well vacation ownership and vacation rental management businesses.

Total active members - Active members of the Interval Network in good standing as of the end of the period. All Vistana Signature Network and Hyatt Residence Club members are also members of the Interval Network.

Tour flow – Represents the number of sales presentations given at sales centers (other than at unconsolidated properties) during the period.

Transaction revenue – Interval Network, Vistana Signature Network and Hyatt Residence Club transactional and service fees paid primarily for exchanges, Getaways, reservation servicing and related transactions.

Volume per guest – Consolidated timeshare contract sales excluding telesales, divided by tour flow during the period.

ILG, Inc.

Investor Contact

Lily Arteaga

305-925-7302

Investor Relations

Lily.Arteaga@ilg.com

Or

Media Contact

Christine Boesch

305-925-7267

Corporate Communications

Chris.Boesch@ilg.com